Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

| Info | ||

|---|---|---|

| ||

Open Enrollment for the 2025 plan year is tentatively scheduled to run from November 11 to November 20. Sequoia will host aninformational session on Tuesday, November 12 at 12:00 PM EST. Additional plan details and information will be shared in #reg-north-america on November 4. |

| Info | ||

|---|---|---|

| ||

Effective July 1, 2024, Camunda has partnered with Sequoia as our new benefits broker. While all your current benefits remain the same, this change brings an enhanced service experience and improved tools for managing your benefits. To help you understand these changes, here are two informative videos:

We encourage you to watch these videos to familiarize yourself with the new platform and your benefits. |

Thank you for being a part of our team. Your health and wellbeing are important to us. We are proud to offer comprehensive benefits for you and your family members that demonstrate our commitment to your overall wellness and satisfaction.

1] Benefits Overview

Camunda offers the following benefits:

| Benefit Type | Carrier |

|---|---|

| Medical | Cigna For the HSA plan, there is a Camunda contribution of: $2,000 for individuals/$4,000 for families annually prorated based on hire date. |

| Dental | Cigna |

| Vision | VSP |

| Flexible Spending Accounts | Health Equity Health Care and Dependent Care FSAs are available |

| Basic Life & ADD | Unum |

| Voluntary Life & ADD | Unum |

| Employee Assistance Program | Unum |

| 401(k) - including a match with instant vesting! | Guideline |

There are also other perks included in each benefit that are detailed below in the Digital Benefits Guide.

Payroll is administered semi-monthly on the 15th/last day of the month. Payroll elections can be done via Gusto.

For any benefits-related questions or issues, please contact Sequoia support through the Sequoia People Platform. They are your first point of contact for any queries. If needed, you can escalate to the Camunda People team for further assistance at people-operations@camunda.com.

2] 2024 Camunda Inc. Benefits

For a summary of benefits and costs, please see the Camunda 2024 Benefit Summary and full details in the digital benefits guide via the Sequoia People platform. Health Related Benefits are elected through the Sequoia Benefits Portal.

We have selected Cigna as our medical and dental carrier in part based on Cigna's commitment to DE&I which is of the utmost importance to the experience of Camundi.

As of April 1, 2024 the prescription formulary has been enhanced to the Performance Formulary. Additionally, the maximum allowable reimbursement for out-of-network providers has changed from 110% to 200%.

401(k) Employee Retirement Plan

Camunda Inc employees are eligible to participate in the 401(k) retirement plan. Camunda matches 100% of employee contributions up to the first 6% of pay and offers both Traditional and Roth 401(k) plan types. This match has no vesting period, and contributions are made per pay period.

Employees become eligible to participate on their date of hire. All employees are auto-enrolled into the plan at a deferral rate of 2% of total compensation for the traditional 401(k) plan. Employees may choose to opt out of the auto-enrollment to receive a refund within 90 days.

Employees will receive an automated email with instructions for enrolling or declining.

Our plan is managed by Guideline: https://www.guideline.com

If an employee leaves Camunda and has a balance of between $50.01 and $5,000 they will be automatically rolled over to a Guideline IRA.

Summary Plan Descriptions for 2024:

Plan Document and Summary Plan Description

Our Benefits Wrap Plan: This ERISA-compliant document combines all our health and welfare benefits into one plan overview, ensuring you have a comprehensive understanding of your coverafe

Medical, PPO 250

Medical, HSA

Pharmacy:

Dental:

Vision:

- VSP Vision Summary of Benefits

VSP Vision Benefits - Additional Features

Enhanced Frame Allowances

- Extra $20 for Featured Frame Brands: Automatically applied by VSP doctors for brands like bebe®, Calvin Klein®, Flexon®, Lacoste®, Nike®, Nine West®, and other select frames. No additional cost or hassle.

- Limited Time Offer: Extra $40 for Converse®, bebe®, Nike®, and Dragon® frames through January 31, 2025.

- Resource

TruHearing Hearing Aid Discount Program

- FREE access (valued at $108) for VSP members

- Up to 60% savings on state-of-the-art digital hearing aids

- Available to VSP members' dependents and extended family

- Resource

Essential Medical Eye Care

- Treatment from VSP doctors for urgent issues (e.g., pink eye, sudden vision changes)

- Monitoring of conditions like dry eye and diabetic eye disease

- Resource

Eyewear Protection Program

- 12-month worry-free warranty

- Free replacement of featured frames purchased from Premier Program doctors if accidentally broken or damaged

- Resource

Eyeconic® Online Store

- Apply VSP benefits directly to online purchases

- Virtual try-on feature for glasses

- Free shipping and returns

- Competitive pricing

- Options for home delivery or shipment to a VSP practice

- Resource

Unum:

- Unum Short-Term Disability Summary

- Unum Voluntary Life Summary

- Unum Disability Plan Summary

- Unum Basic Life AD&D Summary

- Policy- Voluntary benefits

- Policy- STD:LTD

- Policy- Employer paid

Group Plan Numbers (for reference):

| Carrier | Group Plan Number |

|---|---|

| Cigna | 652549 |

| VSP | 30101179 |

| Unum | 0959027 (Life/AD&D, STD, LTD) |

Camunda Inc Employees

Thank youfor being a part of our team. Your health and wellbeing are important to us. We are proud to offer benefits for you and your family members that demonstrates that commitment. Camunda offers:- Medical via BCBS in 2023 and Cigna in 2024

- For the HSA plan, there is a Camunda contribution of $2,000 for individuals/$4,000 for families annually prorated based on hire date.

- Dental via BCBS in 2023 and Cigna in 2024

- Vision via VSP

- Flexible Spending Accounts and Dependent Care Flexible Spending accounts via Health Equity

- Basic Life/ADD & Disability via SunLife in 2023 and Unum in 2024

- Voluntary Life/ADD via SunLife in 2023 and Unum in 2024

- Employee Assistance Program via SunLife through ComPsych in 2023

- 401(k) (including a match with instant vesting!) via Guideline

There are also other perks included from each benefit that are detailed below in the Employee Benefits Guide.

Payroll is administered semi-monthly on the 15th/last day of the month. Payroll elections can be done via Gusto.

Please send your benefits questions to: people-operations@camunda.com

2024 Camunda Inc. Benefits

Open Enrollment

Open Enrollment for 2024 benefits will take place fromNovember 15th to November 27th. This will be a passive enrollment for medical, dental, vision, and voluntary life insurance. While we have a new carrier for 2024, the plan types will stay the same (but with some coverages changed). Meaning, if you do not want to change your benefit elections from 2023 for you or your dependents, they will carry over to 2024. The effective date of the 2024 benefits is January 1, 2024.- Any employees who want to participate in an FSA or Dependent Care FSA must actively elect this benefit for 2024 during open enrollment. A passive enrollment is not an option for FSA or Dependent Care FSA elections.

Full summary plan descriptions and the digital benefits guide will be available during open enrollment. For a summary of 2024 benefits and costs, please see the Camunda 2024 Benefit Summary. A summary of how the plans changed from 2023 to 2024 can be found in the following document.

The change in carriers has allowed us to enhance our benefit offerings while keeping costs the same for employees in 2024. Cigna also has a commitment to DE&I that is of the utmost importance to the experience of Camundi. We understand that a carrier change may impact your current providers. For any questions relating to the impact of the new plans, please feel free to reach out to support@Lumity.com as they are available to support you.

The People team and Lumity (our benefits broker) will be hosting an Open Enrollment meeting onNovember 17th at 2:30 pm ETto answer any questions you may have. This session will also be recorded and shared after the call.2023 Camunda Inc. Benefits

For a summary of the 2023 benefits and costs, please see the Camunda 2023 Benefit Summary. A full benefits overview can be found in the 2023 Employee Benefit Guide. Health Related Benefits are elected through Lumity.

Lumity

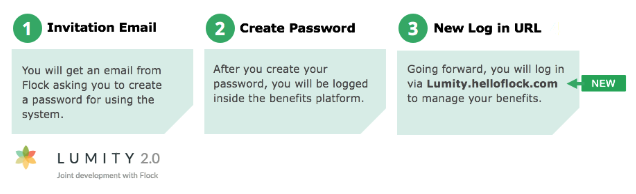

The People Team is excited to announce that we will be migrating our benefits administration platform from Employee Navigator to Lumity starting on April 1, 2023! In line with the company theme of empowerment for speed, we have selected this new system to ensure a focus on our customers (in this case our employees!) by enabling the best possible experience in benefits selection and support.

There will be a blackout period for benefits changes from Monday March 27th through Thursday March 30th while we finalize the transition from Employee Navigator to Lumity.

To create your Lumity account, you will receive an email from Flock the week of April 1st. This account will be used during open enrollment and for any qualifying life events that may happen throughout the year.

Benefits Administration Platform

Below is more information on how to create our account with Lumity via Flock. We are also working with Lumity to enable SSO as a next iteration.  Image RemovedFor reference (and for a preview of the new platform), please also see the Lumity 2.0 Employee Quick Start Guide.

Image RemovedFor reference (and for a preview of the new platform), please also see the Lumity 2.0 Employee Quick Start Guide.

Lumity Mobile App

Access your medical, dental & vision ID cards and high level plan details - anywhere, anytime. A health insurance advocate is only one-click away (for benefit questions and claims assistance).

Lumity digital ID cards become available on your plan effective date or shortly after the insurance carriers process your benefit elections (for New Hires / Qualifying Life Events).

Lumity Support

Concierge benefits support including 1:1 Benefit Consults (virtual calendar available for scheduling).

Lumity Support is here to help with:

- ID cards

- Selecting a health plan that best meets your needs

- Requesting “Continuity of Care” (when switching medical carriers, certain situations qualify for a transitional period where the new health plan would treat medical bills as if you received in-network care)

- Navigating “Prior Authorizations” (medical & prescriptions)

- Understanding spending accounts such as HSA and FSAs

- Finding in-network doctors/providers

- Getting answers to pharmacy coverage questions

- Expediting carrier enrollment for urgent situations

- Navigating insurance claims issues/denials

- Addressing domestic partner benefit questions

- Submitting a qualifying life event (new baby, marriage, divorce, etc.)

- Resetting passwords (for systems we have access to)

- Learning how to enroll in COBRA

- And more...

How to Contact Lumity Support

There are 3 ways to reach Lumity Support:

- Call 1-844-2-LUMITY (1-844-258-6489)

- For immediate assistance and the fastest response, call during business hours:

Monday - Friday, 6AM - 5PM PT / 9AM - 8PM ET (excluding national holidays)

- For immediate assistance and the fastest response, call during business hours:

- Email support@Lumity.com

- Via the Lumity Mobile App

You can also schedule a 1:1 Benefits Consultation from Camunda’s digital benefits guide or through the Lumity mobile app.

For a preview of the service you can expect, we invite you to check out this 2-min welcome video from Lumity’s support team.

Summary Plan Descriptions for 2023:

BCBS PPO HRA - Summary of Benefits

BCBS PPO HRA - Summary Plan Document

BCBS PPO - HSA Summary of Benefits

BCBS PPO - HSA Summary Plan Document

Group Plan Numbers (for reference)

| Carrier | Group Plan Number |

|---|---|

| BCBS | HRA: 002375437 HSA: 002375439 |

| VSP | 30101179 |

| Sunlife | 942995 |

| Health Equity | 5569006 |

ID Cards

Most ID cards take 10-15 business days after enrollment to arrive. If you do not receive an ID card, please reach out to Emily Cady for assistance.For those benefits that do not provide ID cards, your provider (doctor)

- All ID cards can be located in the Sequoia People Platform or via the mobile app.

- Note: These cards will start to become available from mid-July as Sequoia sets up integrations with our various vendors. This process may take anything from 2-4 weeks or more and is dependent on how fast the vendor is able to complete the integration.

- You can also access your digital ID health card via the myCigna member portal.

- Physical ID cards will be mailed if requested. This request can be placed in your myCigna member portal.

- For those benefits that do not provide ID cards, your provider will be able to look up your coverage via your SSN

| Benefit Type | Provider | Physical ID Card | Mobile App | Online Account Registration | Website | |

|---|---|---|---|---|---|---|

| Medical & Dental | Blue Cross Blue Shield | Cigna | NoYes | Yes | Yes | www.bluecrossma.orghttps://my.cigna.com/ |

| Vision | VSP | No | Yes | Yes | https://www.vsp.com/ | |

| Flexible Spending Account (FSA) | Health Equity | Yes | Yes | Yes | https://my.healthequity.com/ | |

| Dependent Care Account (DCRA) | Health Equity | No | Yes | Yes | https://my.healthequity.com/ | |

| Health Savings Account (HSA) | Health Equity | Yes | Yes | Yes | https://my.healthequity.com/ | |

| Health Reimbursement Arrangement (HRA) | Health Equity | No | Yes | Yes | https://my.healthequity.com/ |

You are not required to create an online account with any of our providers, however we do find them to be beneficial. You can view claims, find providers, submit claims, view balances, and much more.

Medical ID Cards for 2023

BCBS is making a change to the pharmacy benefit manager (PBM) effective January 1, 2023. Because of the PBM change, all members with pharmacy benefits will be receiving new ID cards with the information pharmacies will use to process prescriptions. BCBS has started sending those cards in 2022 to ensure members have them in hand for January 1.

Here’s What You Need to Know

- Members should continue to use their current ID cards until January 1.

- Starting January 1, members can dispose of their old ID card and use the new card.

- Members using the digital ID card on MyBlue will see the new card starting January 1. MyBlue Member App FAQ

- Pharmacies have been told about the PBM change and will have the necessary information to process prescriptions both before and after January 1.

- If members are impacted by any other changes (ex: change to mail service pharmacy), they will be receiving letters from BCBS in November letting them know what they need to do.

Qualifying Life Events

Qualifying Life Events need to be submitted into Lumity within 30 days of the event.

The list of Qualifying Life Events can be found below.

- Loss of other Coverage

- Turning 26 and losing coverage through a parent’s plan

- Marriage

- Divorce

- Birth or Adoption of a Child

- Death in the Family

Additional information on Qualifying Life Events can be found here.

Submitting a Qualifying Life Event in Lumity

- Log into Lumity via Okta

- Select the green "Update Benefits" button

- Select the "Life Event" option and make any changes.

- Once submitted, the People Ops team will be notified, and your benefits will be approved and updated in Gusto based on the effective date of your change by Emily Cady.

- If the effective date is backdated, you will see additional deductions taken from your next pay cycle based on the contribution changes in your event.

Updating Health Account Contributions

HSA

- HSA contributions can be updated at any point throughout the year. To update your contributions, please follow the steps below.

- Log into Lumity via Okta.

- Select "Update Benefits" → "Health Accounts" → enter your updated contribution.

- Any HSA contribution changes will be effective in the following pay cycle.

FSA

- FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

Dependent Care FSA

- Dependent Care FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

BCBS Reproductive Health Travel Benefit

Given the impact and implications of the US Supreme Court overturning Roe v. Wade, BCBS has taken steps to support its members, especially those who no longer have access to abortion services in their state of residence. BCBS has developed a travel benefit for Camunda to offer to our employees who need to travel to obtain access to surgical or medication-assisted abortion services. These services will be retroactive to July 1, 2022.

Camunda employees are eligible for an Annual Benefit Maximum of $5,000. Please note that employees must satisfy the plan deductible before this benefit takes effect. See below for additional information about the Reproductive Health Travel Benefit.

Category

• Travel benefit will be available to members obtaining either surgical or medication-assisted voluntary

termination of pregnancy (abortion) services

• Members must need to travel at least 100+ miles from their home to obtain care

• Member attestation process will be leveraged

care for round trip (air, train, bus, taxi/ride sharing services, or car rental) transportation cost

• Mileage reimbursement will be based on the current IRS medical mileage reimbursement ($0.22 per mile for

2022); Tolls and parking are also reimbursable expenses

• Airfare is limited to commercially scheduled, coach class tickets and does not count to daily travel maximum,

if one is established by the employer, but does apply to benefit maximum

• Member attestation process will be leveraged

safety (limited to 1 companion)

• Alcohol/tobacco

• Entertainment / Souvenirs

• Expenses for persons other

than the patient and his/her

covered companion

• Lodging in any location other

than a hotel or motel Personal

care items (e.g., shampoo,

deodorant, toothbrush etc.)

• Telephone calls

• Taxes

• Tips/Gratuity

• Childcare Expenses

• Lost Wages

401(k) Employee Retirement Plan

Camunda Inc employees are eligible to participate in the 401(k) retirement plan. Camunda matches 100% of employee contributions up to the first 6% of pay and offers both Traditional and Roth 401(k) plan types. This match has no vesting period, and contributions are made per pay period.

Employees become eligible to participate on their date of hire. All employees are auto-enrolled into the plan at a deferral rate of 2% of total compensation for the traditional 401(k) plan. Employees may choose to opt out of the auto-enrollment to receive a refund within 90 days.

Employees will receive an automated email with instructions for enrolling or declining.

Our plan is managed by Guideline: https://www.guideline.com

If an employee leaves Camunda and has a balance of between $50.01 and $5,000 they will be automatically rolled over to a Guideline IRA.

At-Home COVID Test Coverage

We anticipate additional updates to this process in the coming weeks and will be sure to pass them along

Updated January 14, 2022

Blue Cross Blue Shield of Massachusetts is covering the costs of FDA-authorized, rapid, at-home COVID tests for commercial members for the duration of the federal public health emergency, in accordance with the federal government’s new guidance, effective Jan. 15, 2022.

In line with the guidance, we will cover up to eight self-administered at-home COVID tests per commercial member per month for personal, diagnostic use, without cost-share and without any need for prior clinical assessment. The coverage is not retroactive and will not apply to any test kit purchases made prior to Jan. 15.

Starting Jan. 15, eligible members can download this form, print it out and mail or email it to the addresses listed on the form. Members should save copies of their receipts, which may be requested at a later time.

Blue Cross is creating a national preferred pharmacy network that will initially include over 20,000 retail pharmacies. In the near future, when the network is up and running, Blue Cross members will be able to go to a preferred pharmacy, such as CVS or Walmart, and obtain certain authorized tests for $0. For members who buy different tests or tests outside this preferred pharmacy network, Blue Cross will reimburse up to $12 per test ($24 for a box of two).

Temporarily, until the network of preferred retail pharmacies is active, Blue Cross will reimburse for the full cost of any FDA-authorized, self-administered test bought at any retailer that typically sells COVID tests.

We will provide more information via our website in coming days. In the meantime, if you purchase an at-home test kit on or after Jan. 15, please save copies of your receipts, download the above form and submit it, or make a claim online via our new system next month.

Blue Cross continues to cover FDA-authorized COVID diagnostic tests, such as PCR tests, with no cost share for any member when ordered or administered by a health care provider following an individualized clinical assessment. This applies to all commercial and Medicare members.

The health of our members is our priority, as always. We are working to implement this new coverage for over the counter at-home COVID tests as quickly and simply as possible. We expect our processes to continue to evolve. We will keep our members informed as we progress.

Additional Information

Link to below announcement: At home Covid test coverage | Blue Cross Blue Shield of Massachusetts (bluecrossma.org)

Link to BCBS Coronavirus Resource Center: Coronavirus Resource Center | Blue Cross Blue Shield of Massachusetts (bluecrossma.org)

Link to BCBS Reimbursement form: COVID-19 at-home test reimbursement (bluecrossma.com)

Useful Documents

Blue Cross Blue Shield Benefits

Blue Cross Blue Shields: Reproductive Health Travel Benefit

VSP TruHearing Hearing Aid Discount

Online Will Preparation- SunLife

Illinois Essential Health Benefit Listing

2023 Model Creditable Coverage Disclosure Notice

ID Cards

Most ID cards take 10-15 business days after enrollment to arrive. If you do not receive an ID card, please reach out to the People Ops team for assistance.

For those benefits that do not provide ID cards, your provider (doctor) will be able to look up your coverage via your SSN.

You are not required to create an online account with any of our providers, however we do find them to be beneficial. You can view claims, find providers, submit claims, view balances, and much more.

3] SaveOn Copay Assistance

What is SaveOnSP?

SaveOnSP is a company that helps plan sponsors and participants reduce the high cost of certain specialty medications. They offer services to implement a copay assistance benefit that is compliant with Affordable Care Act (ACA) requirements. The copay assistance benefit leverages manufacturer copay assistance to help plan participants overcome financial barriers and adhere to their specialty medication treatment.

How the SaveOnSP Program Works

- SaveOnSP classifies certain specialty medications as non-essential health benefits under ACA rules. This allows higher cost-sharing to apply without the costs counting towards the participant's deductible or out-of-pocket maximums, resulting in overall savings for the plan.

- SaveOnSP partners with the plan's specialty pharmacy to administer the copay assistance benefit. Participants are directed to SaveOnSP, who helps them enroll in the manufacturer's copay assistance program to lower their out-of-pocket costs.

- After an employee enrolls, the standard Cigna pharmacy claim is processed, then the patient responsibility amount is billed to the manufacturer for copay assistance.

- Once manufacturer funds are applied, Cigna re-adjudicates the claim to lower the employee's actual out-of-pocket cost through their out-of-pocket adjuster program.

How to Enroll in SaveOnSP

Camunda employees can contact SaveOnSP directly at 1-800-683-1074 to enroll in the program and apply for copay assistance. Cigna strongly recommends having each Camundi contact the SaveOnSP team directly to enroll and get their individual questions answered about the program.

SaveOnSP Contact Information

For plan participant assistance, contact SaveOnSP at:

Phone: 1-800-683-1074

Hours: Monday — Thursday 8:00AM — 11:00 PM EST, Friday 8:00 AM — 9:00 PM EST

For pharmacy assistance, contact SaveOnSP at:

Phone: 1-833-955-3404

4] Virtual Care Services- MD Live

Revolutionizing Your Healthcare Experience

In today's fast-paced world, your time and health are precious. Virtual care is transforming how you access healthcare, offering a seamless blend of technology and medical expertise. This innovative approach allows you to connect with healthcare providers via video or phone, bringing quality care directly to you, wherever you are.

Why Choose Virtual Care?

- Unparalleled Convenience:

- Skip the waiting room and travel time

- Access care from home, office, or while traveling

- 24/7 availability, including holidays

- Cost-Effective Solution:

- Lower costs compared to ER or urgent care visits

- Potential savings on transportation and time off work

- Quality Care, On Your Terms:

- Connect with board-certified doctors and specialists

- Consistent care with options to see the same provider

- Ideal for both urgent issues and ongoing health management

- Privacy and Comfort:

- Discuss health concerns from the privacy of your chosen space

- Reduce anxiety associated with in-person visits

- Efficient Health Management:

- Quick prescription refills when appropriate

- Easy follow-ups for chronic condition management

- Seamless integration with your overall health plan

Services Available

- Urgent Care: Immediate help for non-emergency issues

- Preventive Care: Routine check-ups and wellness screenings

- Mental Health: Therapy and psychiatric services

- Specialized Care: Dental and dermatology consultations

How to Access

- Log in to myCigna.com or the myCigna app

- Select "Virtual Care"

- Choose your service

- Connect with a provider

5] Cigna Travel Health Benefit

Cigna's travel health benefit offerings can be found in the table below. Additional details regarding cost, travel radius, covered travel expenses, providers, and claim reimbursement can be found here.

Travel Coverage Offerings | State-limited access to covered services, including but not limited to:

|

|---|---|

Mental Health and Substance Use Disorder (MHSUD) services where providers are not available within a certain mile radius.

| |

Short list of covered services where providers are not available within a certain mile radius:

|

6] Qualifying Life Events

Qualifying Life Events need to be submitted into the Sequoia Benefits Portal within 30 days of the event.

The list of Qualifying Life Events can be found below.

- Loss of other Coverage

- Turning 26 and losing coverage through a parent’s plan

- Marriage

- Divorce

- Birth or Adoption of a Child

- Death in the Family

Additional information on Qualifying Life Events can be found here, and an information video, here.

Submitting a Qualifying Life Event in Sequoia

- Log into Sequoia Benefits Portal

- Navigate to the left hand side bar and expand the "Life Events" section in orange

- Select the Appropriate life event

- If applicable select the blue plus icon to add a dependent, providing the relevant details before selecting continue

- Once submitted, the People Ops team will be notified, and your benefits will be approved and updated in Gusto based on the effective date of your change by Emily Cady.

- If the effective date is backdated, you will see additional deductions taken from your next pay cycle based on the contribution changes in your event.

For a video tutorial of the above process, have a look here- Submitting a qualifying life event via the Sequoia Benefits Portal [Link to video]

Child Dependents Aging Out of Healthcare Coverage

Key Points:

- Coverage ends: Last day of the month your child turns 26

- Action required: File a Qualifying Life Event (QLE) in Sequoia Benefits Portal

- This can only be done on the day they are no longer eligible

- Deadline: Within 30 days of child's 26th birthday

- Consequence: Missing the deadline may forfeit COBRA eligibility

Action Steps:

- File QLE

- Where: Sequoia Benefits Portal (zcamunda.bswift.com)

- What: Report child aging out of coverage

- COBRA Process

- Camunda approves QLE and initiates COBRA

- Child receives COBRA packet – review immediately as there are limitations for when COBRA remains active

For your Dependents, COBRA continuation coverage is available for up to 36 months from the date of the QLE

Need Help?

- Contact: Sequoia advocate team via the Sequoia People Platform or camunda@help.sequoia.com, or ask in #ask-people-team in slack.

7] Adding Beneficiaries

Your Life/AD&D plans require you to add a beneficiary in the event of your disability or death. Adding a beneficiary ensures your family/estate are well protected in the event of any incident.

Once signed into the Sequoia Benefits Portal. navigate to My Profile > Beneficiaries (screenshot)

Or navigate to your Life/AD&D benefit and select "Manage Beneficiaries"

You will then be presented with a window in which you can select from your current dependents or upload a new beneficiary

Make your selection and click "Add Selected"

- Note: Camundi who were employed at the time of our transition from Lumity to Sequoia (1 July 2024) are required to re-add their beneficiaries, as this data cannot be reliably transferred over from our prior benefits administration platform (flock)

8] Updating Health Account Contributions

HSA

- HSA contributions can be updated at any point throughout the year. To update your contributions, please follow the steps below.

- Log into the Sequoia People Platform via Okta.

- Navigate to the Sequoia Benefits Portal.

- Select "Update Benefits" → "Health Accounts" → enter your updated contribution.

- Any HSA contribution changes will be effective in the following pay cycle.

FSA

- FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

Dependent Care FSA

- Dependent Care FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

9] Medicare- Creditable Coverage

Notification for Medicare eligible policyholders that our prescription drug coverage is “creditable coverage”.

What is Creditable Coverage?

Creditable means that our employer medical plan coverage is expected to pay on average as much as the standard Medicare prescription drug coverage.

We have confirmed that our medical plans are creditable.

10] Sequoia & Your Digital Platforms

Benefits Management is maintained via Sequoia with the goal of enabling the best possible experience in benefits selection and support.

Benefits Administration Platform

All US Camundi can Log into the two core Sequoia platforms:

How do I log in?

Accessing the Sequoia People & Benefits Platforms

🎥Watch this short zoom clip for details! - here (This clip is accessible to all active Camundi with a Camunda email address)

What is each platform for?

Sequoia Benefits Portal

Access via Okta tile

Use for: Enrolments and Qualifying Life Events (QLEs)

- Registration: The temporary password to register for the benefits portal is the last 4 digits of your SSN.

Sequoia People Platform

Access via Okta tile

Use for: Day-to-day benefits info, ID cards, support, and more

Sequoia Mobile App

Access your medical, dental & vision ID cards and high-level plan details - anywhere, anytime. A health insurance advocate is only one-click away (for benefit questions and claims assistance).

Sequoia digital ID cards become available on your plan effective date or shortly after the insurance carriers process your benefit elections (for New Hires / Qualifying Life Events).

Getting Started with the Sequoia mobile App:

You can get the latest version from the Apple App Store or Google Play.

- Registration: If you haven’t signed up, use your work email, and create a password with at least 8 characters. Passwords must contain a lowercase letter, uppercase letter, a number, and no parts of your email

- Access Benefit Resources: Explore the app to view detailed benefit information, access your ID cards, and discover additional resources.

- Add Dependents:

- Invite dependents to join the mobile app.

- If any dependents aren't listed, add them manually by selecting your profile icon > invite dependents.

Additional information on Sequoias' mobile app can be found here.

Sequoia Support

| Note |

|---|

For any benefits-related questions or issues, please contact Sequoia support through the Sequoia People Platform or via email. They are your first point of contact for any queries, with a dedicated team ready to assist you. Using this support channel ensures we maintain the highest levels of privacy. The people team is also here to support you and ensure you have the best experience. For further assistance, escalate your concerns to the Camunda People team via #ask-people-team and tag Wesley Hattingh or Emily Cady for action. |

Your benefits advocate is available to support with:

- ID cards

- Selecting a health plan that best meets your needs

- Requesting “Continuity of Care” (when switching medical carriers, certain situations qualify for a transitional period where the new health plan would treat medical bills as if you received in-network care)

- Navigating “Prior Authorizations” (medical & prescriptions)

- Understanding spending accounts such as HSA and FSAs

- Finding in-network doctors/providers

- Getting answers to pharmacy coverage questions

- Expediting carrier enrollment for urgent situations

- Navigating insurance claims issues/denials

- Addressing domestic partner benefit questions

- Submitting a qualifying life event (new baby, marriage, divorce, etc.)

- Resetting passwords (for systems we have access to)

- Learning how to enroll in COBRA

- And more...

How to Contact your Sequoia support advocate:

There are 3 main ways to reach Sequoia Support, in order of data security and speed of response:

- Via the Sequoia Mobile App or the Sequoia People Platform (access via Okta)

- click on your profile picture in the top right

- navigate to "My Advocate"

- Open a case to receive support

- Email camunda@help.sequoia.com

- Telephone:

- Available Monday to Friday, 8:30-5:00PST

- (844)-891-3044

Upcoming Sessions and Recordings

| Topic | Format | Audience | Date & Time | Session Length | Recording | Slack Message |

|---|---|---|---|---|---|---|

| Sequoia Lunch and Learn to get up to speed on how to navigate all the features offered by our new broker, get the most out of your benefits, and get support when you need it. | Webinar | All US-based Camundi | July 17, 2024 at 12pm EST | 60 minutes | Camunda and Sequoia Introduction Lunch and Learn Recording | Important Update: Welcoming Sequoia as Our New Benefits Partner! |

11] Additional Resources

Summary Annual Report (SAR) Distribution

The Summary Annual Report (SAR) for our employee benefit plans is distributed annually to all plan participants. You can find the most recent SAR for the 2023 plan year, here. Please review it for important information about our benefit plans.

HIPAA Compliance at Camunda

Camunda is committed to protecting the privacy and security of protected health information (PHI) in accordance with HIPAA regulations. As a business associate, we have implemented comprehensive safeguards and procedures, including:

- Strict access controls and security measures for PHI

- Regular employee training on HIPAA compliance

- Incident response and breach notification processes

- Ongoing risk assessments and security audits

Employees handling PHI receive additional specialized annual training.

For more information on Camund's HIPAA compliance efforts, please refer to our full HIPAA Compliance Overview.

Helpful brochures

- Welcome to Cigna Brochure- 2024

- Cigna One Guide Pre-Enrollment Flyer

- Transitioning to Digital ID Cards

- 2024 Wellness Resources

- Cigna EAP Flyer

- Unum EAP Flyer

- Cigna and weight management support

12] Exit Process

Medical/Dental/Vision

If you are enrolled in medical, dental, and/or vision coverage, your coverage will expire on the last day of your month of separation. For example, if your last day of employment is January 1st, your benefits would be active through January 31st.

You will be eligible to continue your current coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA) for up to 18 months as outlined below.

COBRA

Approximately ten days after your separation date you will receive a COBRA notification and election form from WageWorks, our COBRA administrator. If you do not receive information, please contact Emily Cady (Emily.Cady@camunda.com).

IF YOU WANT TO CONTINUE YOUR CURRENT COVERAGE, YOU MUST ACTIVELY ELECT COBRA. ENROLLMENT IS NOT AN AUTOMATED PROCESS!

You must complete and submit the enrollment documents within 60 days of your separation date or the date of the COBRA notice, whichever is later to continue group health, dental and/or vision coverage pursuant to COBRA.

Once you have enrolled and paid the first month’s premiums, your coverage will be reinstated retroactively to the day following your separation date or the date of loss of coverage so there's no gap in coverage.

Once your coverage is reinstated, claims incurred after your separation date should be submitted to your carrier for processing.

Voluntary Life Continuation

If you are enrolled in voluntary life coverage, you will receive an email from Unum to your personal account containing a Portability Coverage form, Conversion form, and resource material outlining eligibility and FAQ's.

Spending Accounts

Health Savings Account (HSA)

If you are enrolled in a Health Savings Account (HSA) your account will remain active beyond your separation date.

Employer and employee contributions will end effective your last paycheck, but you will continue to be able to utilize your funds for eligible expenses. Funds in the account never expire.

Health Equity will reach out to inform you of their monthly fees for administering the account after your separation date.

You may choose to rollover your HSA funds into a new employer account. Health Equity can assist with that directly.

Flexible Spending Account (FSA)

If you are enrolled in a Flexible Spending Account (FSA), you have ninety (90) days from your date of separation in which to file a claim. All claims submitted must be for services and expenses incurred on or before your separation date.

Unused Funds:

Any funds remaining in your account for which no eligible claims have been submitted within ninety (90) days of your separation will be forfeited.

For any unused funds, you have the option to extend your FSA beyond your date of separation through COBRA.

You may file a claim with Health Equity through your online account (www.myhealthequity.com) or through their mobile app.

Dependent Care Savings Account (DCFSA)

If you are enrolled in a Dependent Care Savings Account you have ninety (90) days from your date of separation in which to file a claim. All claims submitted must be for services and expenses incurred on or before your separation date.

Any funds remaining in your account for which no eligible claims have been submitted within ninety (90) days of your separation will be forfeited.

You may file a claim with Health Equity through your online account (www.myhealthequity.com) or through their mobile app.

Carrier Contact Information

Benefit Type | Provider | Group ID | Phone Number | Website |

Medical | Cigna | 00652549 | 1 (800) 244-6224 | |

Dental | Cigna | 00652549 | 1 (800) 244-6224 | |

Vision | VSP | 30101179 | 1-800-877-7195 | |

Spending Accounts (HSA/FSA/DCFSA) | Health Equity | 5569006 | 866-346-5800 | |

401k | Guideline | N/A | 888-344-5188 |

Monthly COBRA Costs

The below costs do not include any administrative fees for managing the plans. In general, Health Equity charges a 2% fee in addition to the rates listed below.

Benefit Type | Employee | Employee + Spouse | Employee + Child(ren) | Employee + Family |

Medical - Cigna PPO 250 | $953.29 | $1,906.57 | $1,711.14 | $2,883.69 |

Medical - Cigna HSA 2000 | $646.79 | $1,293.58 | $1,160.99 | $1,956.54 |

Dental | $35.04 | $72.48 | $72.54 | $116.93 |

Vision | $6.79 | $10.86 | $11.08 | $17.87 |

| Page properties |

|---|

| Page properties |

On this Page

| Table of Contents | ||

|---|---|---|

|

| Page properties | ||

|---|---|---|

|