- Created by Emily Cady, last updated by Wesley Hattingh on Dec 16, 2025 13 minute read

Thank you for being a part of our team. Your health and wellbeing are important to us. We are proud to offer comprehensive benefits for you and your family members that demonstrate our commitment to your overall wellness and satisfaction.

Your benefits as an employee of Camunda Inc.

- All information of 2025 benefits, costs, plan summaries, and wellness resources can be found in the Open Enrollment guide in your Sequoia People Platform.

- A summary of how plans changed from 2024-2025 can be found here.

- All benefit elections are made through the Sequoia Benefits Portal.

- Payroll is administered semi-monthly on the 15th/last day of the month. Payroll elections can be done via Gusto.

- The Total Rewards team is also here to support you and ensure you have the best experience. For further assistance, escalate your concerns to the Camunda People team via #ask-people-team and tag @total-rewards for action.

Camunda offers the following benefits:

| Benefit Type | Carrier | Cost split | Group Plan Number |

|---|---|---|---|

| Medical | Anthem BCBS For the HDHP HSA account, there is an employer contribution from Camunda of:

| One cost share plan, one fully paid Camunda plan | PPO250: 277727U783 HDHP 1650: 277727U779 HDHP 3600: 277727U781 |

| Dental | Guardian | Cost shared | 00073030 |

| Vision | Guardian | Cost shared | 00073030 |

| Flexible Spending Accounts | Health Equity | Camunda contributes to your HSA ($1,650 Individual | $3,600 Family ) | 5569006 |

| Basic Life & AD&D | Guardian | 100% Camunda Paid | 00073030 |

| Voluntary Life & AD&D | Guardian | 100% Camundi Paid | 00073030 |

| 401(k) - including a match with instant vesting! | Guideline (Acquired by Gusto and will be rebranding as Gusto 401k), features and usage remain identical | Up to 6% match by Camunda | |

| Child Disability Insurance | Juno | 100% Camundi Paid | |

New York Disability Benefit Law (DBL) | Guardian

| 100% Camunda Paid | 00897514-0000 |

What is Ensure Rx?

Ensure Rx is available through Anthem to help you find discounts on prescriptions and compare generic vs. name brand to find the lowest cost option. This perk is included as part of your Anthem Health benefits.

Anthem Travel Benefit

Anthem offering a travel health benefit to cover specific services such as Abortion & Gender Affirmation services. Please review the plan documents and reach out to your provider, Anthem & the Sequoia Advocate Team prior to accessing care for these services. Any service under Anthem's travel health benefit are subject to authorization and pre-approval through Anthem prior to accessing & receiving care.

Additional details regarding this benefit will be released in March, 2025. If you need to access this type of care prior to the release of this information, then please reach out to the Sequoia Advocate team for support.

Medicare Creditable Coverage

What is Creditable Coverage? Creditable means that our employer medical plan coverage is expected to pay on average as much as the standard Medicare prescription drug coverage. We have confirmed that our medical plans are creditable.

Notification for Medicare eligible policyholders that our prescription drug coverage is “creditable coverage”.

401(k) Plan Available at Camunda

Camunda Inc employees are eligible to participate in the 401(k) retirement plan. Camunda matches 100% of employee contributions up to the first 6% of pay and offers both Traditional and Roth 401(k) plan types. This match has no vesting period, and contributions are made per pay period.

Employees become eligible to participate on their date of hire. All employees are auto-enrolled into the plan at a deferral rate of 2% of total compensation for the traditional 401(k) plan. Employees may choose to opt out of the auto-enrollment to receive a refund within 90 days.

Employees will receive an automated email with instructions for enrolling or declining.

Our plan is managed by Guideline: https://www.guideline.com

If an employee leaves Camunda and has a balance of between $50.01 and $5,000 they will be automatically rolled over to a Guideline IRA.

Wellbeing Resources through the Sequoia Tech Program

Having a place to turn for your physical and mental health whenever you need it can be reassuring. That’s where your One Medical benefit comes in. They're a primary care practice that makes it faster, easier, and more enjoyable to get care, anytime — in their offices and 24/7 from your phone.

- Offered services include,

- FAQs can be found here.

- To register:

- Navigate to this site and use the following code - SEQXOMN

- If you have difficulties please contact the advocate team or the dedicated OneMedical line for Sequoia at sequoia@onemedical.com

Carrot Core

Carrot, a pioneering fertility platform, is recognized and highly regarded for its compassionate, all-inclusive approach to fertility and family forming support. With Carrot, everyone, regardless of age, race, income, sex, sexual orientation, gender, marital status, or geography, can access personalized care and resources on their fertility journey. Carrot's dedicated team is always ready to navigate, answer questions, and aid with bookings, complemented by unlimited virtual consultations with a range of specialists.

With Carrot's expert-authored library of resources accessible 24/7 and its affiliation with partner clinics, you benefit from lower rates and expedited bookings. Carrot also features comprehensive pregnancy support, including unlimited access to prenatal classes and nutritional guidance.

Carrot champions each unique fertility journey, understanding the challenges faced along the way. This empathetic approach is backed by a meticulous focus on clinical practices.

- Offered services include,

Personalized Support: Expert guidance for fertility health, parenthood, pregnancy, menopause, and low testosterone.

Comprehensive Care: Unlimited telehealth visits with specialists, educational resources, and hassle-free appointment scheduling.

Convenient Access: Discounts from partner clinics, Carrot Pharmacy delivery, and the innovative Carrot Card for easy payments.

Create your account today to start exploring available resources

Qualifying Life Events

These need to be submitted into the Sequoia Benefits Portal within 30 days of the event.

The list of Qualifying Life Events can be found below.

- Loss of other Coverage

- Turning 26 and losing coverage through a parent’s plan

- Marriage

- Divorce

- Birth or Adoption of a Child

- Death in the Family

Additional information on Qualifying Life Events can be found here, and an informational video, here.

Submitting a Qualifying Life Event in Sequoia

- Log into Sequoia Benefits Portal

- Navigate to the left hand side bar and expand the "Life Events" section in orange

- Select the Appropriate life event

- If applicable select the blue plus icon to add a dependent, providing the relevant details before selecting continue

- Once submitted, the People Ops team will be notified, and your benefits will be approved and updated in Gusto based on the effective date of your event.

- If the effective date is backdated, you will see additional deductions taken from your next pay cycle based on the contribution changes in your event.

For a video tutorial of the above process, have a look here- Submitting a qualifying life event via the Sequoia Benefits Portal [Link to video]

Key Points:

- Coverage ends: Last day of the month your child turns 26

- Action required: File a Qualifying Life Event (QLE) in Sequoia Benefits Portal

- This can only be done on the day they are no longer eligible

- Deadline: Within 30 days of child's 26th birthday

- Consequence: Missing the deadline may forfeit COBRA eligibility

Action Steps:

- File QLE

- Where: Sequoia Benefits Portal (zcamunda.bswift.com)

- What: Report child aging out of coverage

- COBRA Process

- Camunda approves QLE and initiates COBRA

- Child receives COBRA packet – review immediately as there are limitations for when COBRA remains active

For your Dependents, COBRA continuation coverage is available for up to 36 months from the date of the QLE

Need Additional Help?

- Contact: Sequoia advocate team via the Sequoia People Platform or camunda@help.sequoia.com, or ask in #ask-people-team in slack.

Adding Beneficiaries to your Risk Plans

Your Life/AD&D plans require you to add a beneficiary in the event of your disability or death. Adding a beneficiary ensures your family/estate are well protected in the event of any incident.

Once signed into the Sequoia Benefits Portal. navigate to My Profile > Beneficiaries (screenshot)

Or navigate to your Life/AD&D benefit and select "Manage Beneficiaries"

You will then be presented with a window in which you can select from your current dependents or upload a new beneficiary

- Make your selection and click "Add Selected"

Updating your Health Account Contributions

- FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

- Dependent Care FSA contributions can only be updated during Open Enrollment or if you experience a Qualifying Life Event.

Health Savings Account )HSA)

- HSA contributions can be updated at any point throughout the year. To update your contributions, please follow the steps below.

- Navigate to the Sequoia Benefits Portal via Okta.

- Select "Change HSA Amount" → "Health Accounts" → enter your updated contribution.

- Any HSA contribution changes will be effective in the following pay cycle.

Accessing your ID cards

- All ID cards can be located in the Sequoia People Platform or via the mobile app.

- You can also access your digital ID health card via the Anthem member portal.

- Physical ID cards will be mailed if requested. This request can be placed in your Anthem member portal.

- For those benefits that do not provide ID cards, your provider will be able to look up your coverage via your SSN

| Benefit Type | Provider | Physical ID Card | Mobile App | Online Account Registration | Website |

|---|---|---|---|---|---|

| Medical | Anthem | No | Yes | Yes | https://www.anthem.com/ca |

| Dental & Vision | Guardian | No | Yes | Yes | https://www.guardiananytime.com/ |

| Flexible Spending Account (FSA) | Health Equity | Yes | Yes | Yes | https://my.healthequity.com/ |

| Dependent Care Account (DCRA) | Health Equity | No | Yes | Yes | https://my.healthequity.com/ |

| Health Savings Account (HSA) | Health Equity | Yes | Yes | Yes | https://my.healthequity.com/ |

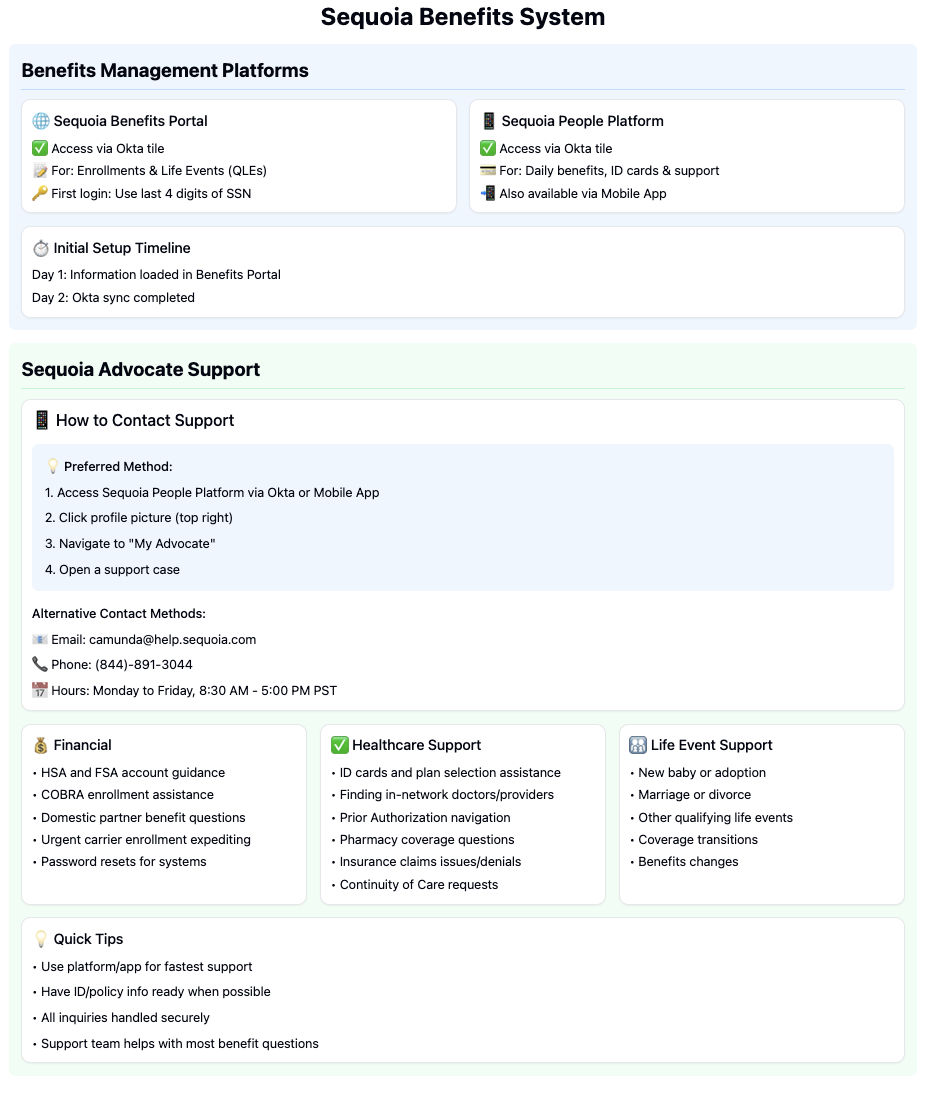

Sequoia & Your Available Digital Platforms

The people team is also here to support you and ensure you have the best experience. For further assistance, escalate your concerns to the Camunda People team via #ask-people-team and tag Wesley Hattingh for action.

Sequoia Advocate Support

How to Contact Support

Preferred Method:

- Access Sequoia People Platform via Okta or Mobile App

- Click profile picture (top right)

- Navigate to "My Advocate"

- Open a support case

Alternative Contact Methods:

- Email: [[camunda@help.sequoia.com]]

- Phone: (844)-891-3044

- Hours: Monday to Friday, 8:30 AM - 5:00 PM PST

- Differentiating the platforms- 🎥Watch this short zoom clip for details! - here

- Sequoia People Platform Introduction: [Link to video]

- Overview of the Sequoia Benefits Portal: [Link to video]

Access your medical, dental & vision ID cards and high-level plan details - anywhere, anytime. A health insurance advocate is only one-click away (for benefit questions and claims assistance).

Sequoia digital ID cards become available on your plan effective date or shortly after the insurance carriers process your benefit elections (for New Hires / Qualifying Life Events).

You can get the latest version from the Apple App Store or Google Play.

- Registration: If you haven’t signed up, use your work email, and create a password with at least 8 characters. Passwords must contain a lowercase letter, uppercase letter, a number, and no parts of your email

- Access Benefit Resources: Explore the app to view detailed benefit information, access your ID cards, and discover additional resources.

- Add Dependents:

- Invite dependents to join the mobile app.

- If any dependents aren't listed, add them manually by selecting your profile icon > invite dependents.

Additional Resources

Topic | Format | Audience | Date & Time | Session Length | Recording | Slack Message |

|---|---|---|---|---|---|---|

| Sequoia Lunch and Learn to get up to speed on how to navigate all the features offered by our new broker, get the most out of your benefits, and get support when you need it. | Webinar | All US-based Camundi | July 17, 2024 at 12pm EST | 60 minutes | Camunda and Sequoia Introduction Lunch and Learn Recording | Important Update: Welcoming Sequoia as Our New Benefits Partner! |

| Open Enrollment Informational Session | Webinar | All US-based Camundi | November 12, 2024 at 12pm EST | 60 minutes | Camunda 2025 Open Enrollment Education Session | Camunda 2025 Open Enrollment Deck |

Evidence of Coverage (EOC) for Plan Year 2025

The finalized 2025 Evidence of Coverage (EOC) documents notice is posted on the Sequoia People Platform. These outline the full details of your plan coverage for the 2025 plan year.

| Benefit Type | Provider | Evidence of Coverage (EOC) |

|---|---|---|

| Medical | Anthem | |

| Dental, Vision, Life & Disability | Guardian |

Camunda is committed to protecting the privacy and security of protected health information (PHI) in accordance with HIPAA regulations. As a business associate, we have implemented comprehensive safeguards and procedures, including:

Strict access controls and security measures for PHI

Regular employee training on HIPAA compliance

Incident response and breach notification processes

Ongoing risk assessments and security audits

Employees handling PHI receive additional specialized annual training. For records of this please contact Wesley Hattingh For more information on Camunda's HIPAA compliance efforts, please refer to our full HIPAA Compliance Overview.

New York Disability Benefits Law (NY DBL)

New York State requires employers to provide short-term disability insurance coverage, known as NY DBL, for eligible employees who are unable to work due to a non-work related illness, injury, or pregnancy.

- Provides partial wage replacement: up to 50% of your average weekly wages, up to the state maximum benefit.

- Coverage is statutory and Camunda-paid, you do not need to enroll separately.

- If you become disabled, you must notify your manager and People Operations as soon as possible to begin your claim.

For full details on eligibility, benefits, and how to file a claim, please refer to the following:

- Required Notice: NY DBL Notice of Compliance Poster

- Policy Information

- Benefit Guide

If you have questions about NY DBL coverage, please reach out to Total Rewards.

Benefit Type | Provider | Group ID | Phone Number | Required Notice & Claims Information |

NY DBL | Guardian | 00897514-0000 | 610-807-2953 |

Exit Process

If you are enrolled in medical, dental, and/or vision coverage, your coverage will expire on the last day of your month of separation. For example, if your last day of employment is January 1st, your benefits would be active through January 31st.

You will be eligible to continue your current coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA) for up to 18 months as outlined below.

COBRA Coverage - What You Need to Know

IMPORTANT: You must actively enroll in COBRA - it is not automatic! (even if your cover is being extended as part of a severance package)

What Will Happen

- WageWorks will mail you COBRA paperwork ~10 days after your last day

- Haven't received it? Contact:

- Reach out to total-rewards@camunda.com

Your Deadlines

- You have 60 days to enroll from your last day or when you get the notice (whichever is later)

- Once you enroll and pay, coverage restarts from your last day - no gaps (if your cover is continued as part of an exit package, you need only elect COBRA and your benefits will be covered in full for the period agreed upon)

- You can continue your current health, dental and vision plans

Monthly COBRA Costs

The below costs do not include any administrative fees for managing the plans. In general, Health Equity charges a 2% fee in addition to the rates listed below.Benefit Type | Employee | Employee + Spouse | Employee + Child(ren) | Employee + Family |

Medical - Anthem PPO 250 | $832.42 | $1,831.45 | $1,498.47 | $2,580.79 |

Medical - Anthem HDHP 1650 | $678.45 | $1,492.60 | $1,221.21 | $2,103.30 |

Dental- Guardian | $47.76 | $95.16 | $113.12 | $160.56 |

Vision- Guardian | $10.01 | $17.17 | $17.54 | $28.27 |

To continue your life insurance coverage through Guardian, please complete this document and send it to nationalconversions@glic.com for processing.

Additional information on rates, enrollment tiers, and eligibility can be found here.

If you are enrolled in a Health Savings Account (HSA) your account will remain active beyond your separation date.

Employer and employee contributions will end effective your last paycheck, but you will continue to be able to utilize your funds for eligible expenses. Funds in the account never expire.

Health Equity will reach out to inform you of their monthly fees for administering the account after your separation date.

You may choose to rollover your HSA funds into a new employer account. Health Equity can assist with that directly.

Flexible Spending Account (FSA)

If you are enrolled in a Flexible Spending Account (FSA), you have ninety (90) days from your date of separation in which to file a claim. All claims submitted must be for services and expenses incurred on or before your separation date.

Unused Funds:

Any funds remaining in your account for which no eligible claims have been submitted within ninety (90) days of your separation will be forfeited.

For any unused funds, you have the option to extend your FSA beyond your date of separation through COBRA.

You may file a claim with Health Equity through your online account (www.myhealthequity.com) or through their mobile app.

Dependent Care Savings Account (DCFSA)

If you are enrolled in a Dependent Care Savings Account you have ninety (90) days from your date of separation in which to file a claim. All claims submitted must be for services and expenses incurred on or before your separation date.

Any funds remaining in your account for which no eligible claims have been submitted within ninety (90) days of your separation will be forfeited.

You may file a claim with Health Equity through your online account (www.myhealthequity.com) or through their mobile app.

Benefit Type | Provider | Group ID | Phone Number | Website |

Medical | Anthem | PPO250: 277727U783 HDHP 1650: 277727U779 HDHP 3600: 277727U781 | 844-898-5148 | https://www.anthem.com/ca |

Dental | Guardian | 00073030 | 800-525-4542 | https://www.guardiananytime.com/ |

Vision | Guardian | 00073030 | 877-814-8970 | https://www.guardiananytime.com/ |

Spending Accounts (HSA/FSA/DCFSA) | Health Equity | 5569006 | 866-346-5800 | |

401k | Guideline | N/A | 888-344-5188 |